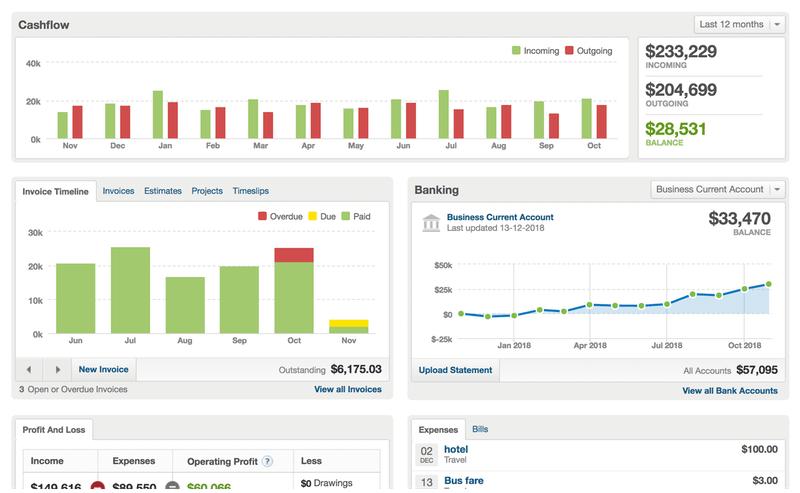

Integrations are another area where Xero stands out, as it connects to over 800 apps and programs. Depending on the plan you select, you may also have access to project management, expense claims, and bill management.

#Best simple accounting software for mac mac

This cloud-based software is compatible with Mac and comes loaded with accounting features, such as invoices, quotes, purchase orders, inventory management, and reports. Unlimited users aren’t all that Xero has going for it, though. For businesses with multiple users, not having to purchase additional licenses for every single user can save hundreds - or thousands! - each year. Xero does one thing that you won’t find with most accounting software: It includes multiple users with no additional fees. Since Wave offers the same accounting features for small businesses as for large enterprises, it’s best for freelancers and business owners with one location and few employees. And Wave has just one accounting plan, so it isn’t particularly scalable. While Wave’s receipt-scanning and invoicing app have good iOS reviews, Wave still doesn’t have a mobile accounting app. It also includes at least as many reports as QuickBooks’ cheapest plan, and you can manage multiple businesses from just one Wave account. Unlike FreshBooks and Xero, it doesn’t limit the number of invoices you can send or clients you can bill.

#Best simple accounting software for mac free

Wave is completely free for life, doesn’t require a credit card, and offers enough features to compare with most paid accounting software options. If saving money is your top concern, Wave should be among your top accounting software picks. AccountEdge is available for a 30 day free trial. Because this is a cloud-based option, it can be accessed from anywhere with an internet connection, and its mobile app targets Mac users with its iMessage and Apple Watch integrations.ĪccountEdge is a complete small business desktop accounting and management solution for your Mac office.

Zoho Books is both affordable and easy-to-use, making this a great choice for freelancers and small businesses who are looking for a suite of tools that will assist them with other aspects of their business, such as project and customer relationship management (CRM). Otherwise, the time you’ll spend inputting payroll numbers into your accounting software outweighs the time you save automating accounting tasks. As a result, we recommend it primarily to freelancers and small businesses with just a few employees. Unfortunately, Zoho Books doesn’t currently sync with payroll software.

They can save you time and are completely customizable to your business’s unique situation. Speaking of automation, Zoho Books’ most unique accounting feature is its automated workflows, which let you automate tedious tasks like sending emails or redirecting crucial customer calls to higher-ups. The pricier plans add automatic bill payment as well. The $15 plan includes automated recurring invoices, expenses, and payment reminders. It also has better automation than top providers like QuickBooks. That’s the same as FreshBooks-but unlike FreshBooks (and Xero), Zoho’s cheapest plan doesn’t limit your invoices or bills. Zoho Books starts at $15 a month (when billed annually). creating and tracking sales and purchases.

0 kommentar(er)

0 kommentar(er)